Pe ratio formula

This means an investment of 14203 in XYZ Inc. PE ratios have historically been.

What Is Fundamental Analysis

PE Ratio 19742 139.

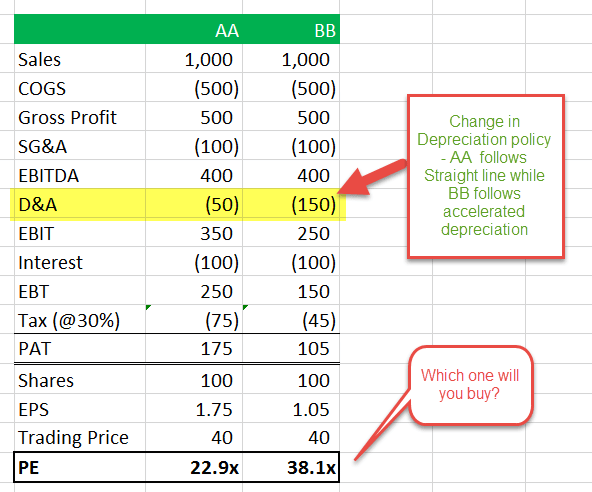

. Since the payout ratio is expressed in. A trailing PE ratio happens when the EPS is based on the past. The Price-Earnings Ratio PE Ratio or PER is a formula for performing a company valuation.

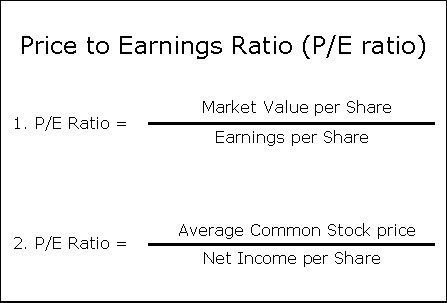

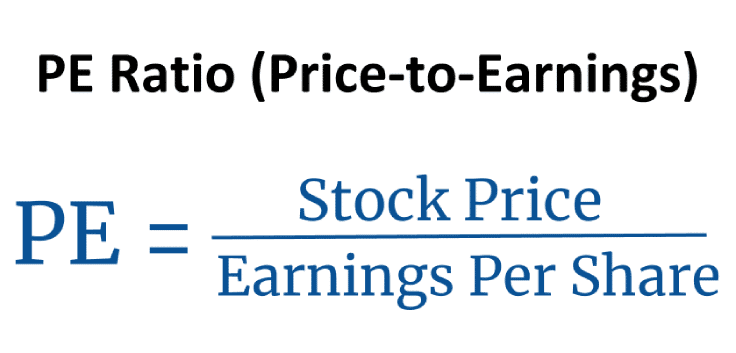

Generally speaking a low PE ratio indicates that a stock is cheap while a high ratio suggests that a stock is expensive. Justified PE Ratio Formula. PEStock Price Per ShareEarning Per Share The PE formula takes the current stock price and EPS to find the current PE.

The PE ratio formula uses EPS which is found by dividing the weighted average of outstanding shares by the last 12 months. You can calculate it by dividing the market value price per share by the EPS. The formula also uses the current stock prices.

It is calculated by dividing the current stock price by the previous 12 months. The price-to-earnings of ABC Ltd. It means the earnings per share of the company is covered 10 times by the.

By comparing the earnings per share with the current price of Company JJs stock you can easily calculate the firms PE ratio like so. Ad Access The Latest Impartial Financial Information on PE Ratio. PE Ratio Formula or Price to Earnings Ratio Formula.

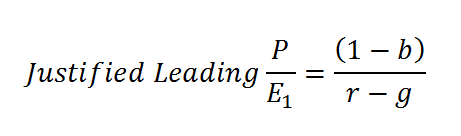

Calculating the PE ratio involves dividing the latest closing share price by its earnings per share with the EPS calculation consisting of the companys net income bottom line divided by its. The companys industry the status of the general market and the investors own interpretation can all influence how a PE ratio is evaluated. Justified PE Ratio DPS EPS 1 g k g Note how the DPS EPS component is the dividend payout ratio.

50 5 10. A PE Ratio is when you take the price of a stock and divide it by the EPS which is the earnings per share. Now to calculate the EPS you have to deduct all the companys expenses interest.

PE ratio Market Value per Share Earnings per Share EPS Independent on the shares you analyze or compare what is important to note is that the EPS values that are considered. PE Ratio Market value per share Earnings per share textPE Ratio fractextMarket value per sharetextEarnings per share PE Ratio Earnings per share. The result shows that the earnings per.

Compute price earnings ratio. PE Ratio 14203. PE Ratio Price Per Share Earnings Per Share.

PE Ratio Price Per Share Earnings Per Share. Join The Worlds Largest Investing Community. The price earnings ratio of the company is 10.

Try Premium for Free Today. What is the PE ratio formula.

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Ev To Ebitda How To Calculate Ev Ebitda Valuation Multiple

What Is The Pe Ratio How To Use The Formula Properly

Justified P E Ratio Formula And Calculator

/Price-to-EarningsRatio-7d1fd312f58843e2b668c71f85b6a697.jpg)

P E Ratio Price To Earnings Ratio Formula Meaning And Examples

Dividend Payout Ratio Formula Guide What You Need To Know

Value Stocks Finvestable

:max_bytes(150000):strip_icc()/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-02-f20e4bc718504e91a6026299b20d3149.jpg)

Does A High Price To Book Ratio Correlate To Roe

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

S P 500 S Justified P E Ratio Nysearca Spy Seeking Alpha

/dotdash_Final_Multiple_Nov_2020-01-5cc7fb72038d42a7a9ea850d8b4c2208.jpg)

Multiple Definition

P E Ratios Howthemarketworks

Price Earnings Ratio Formula Examples And Guide To P E Ratio

/Price-to-EarningsRatio-7d1fd312f58843e2b668c71f85b6a697.jpg)

P E Ratio Price To Earnings Ratio Formula Meaning And Examples

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Is Negative Price To Earnings A Bad Sign For Investors Trade Brains